The process of price formation, or Preisbildung, on a stock exchange is a dynamic interplay of countless factors, reflecting the collective assessment of value by market participants. It’s not a static calculation but a continuous auction where buyers and sellers interact, setting the prices for stocks, bonds, and other financial instruments in real-time. At its core, this intricate mechanism is driven by the fundamental economic principles of supply and demand, yet it is significantly influenced by a myriad of other elements, from breaking news and economic reports to investor psychology and technological advancements. Grasping how these elements converge to establish market prices is fundamental for anyone looking to understand the mechanics of global finance.

Overview

- Preisbildung is primarily governed by the forces of supply and demand on the stock exchange.

- Prices are determined in a continuous auction where buyers’ bids meet sellers’ asks.

- Key factors influencing Preisbildung include corporate earnings, economic data, geopolitical events, and market sentiment.

- Technological advancements and high-frequency trading have significantly accelerated the speed of price adjustments.

- Market participants, from individual investors to institutional traders and market makers, all contribute to the Preisbildung process.

- The efficiency of Preisbildung can reflect the transparency and liquidity of a given market.

The Core Mechanisms of Preisbildung

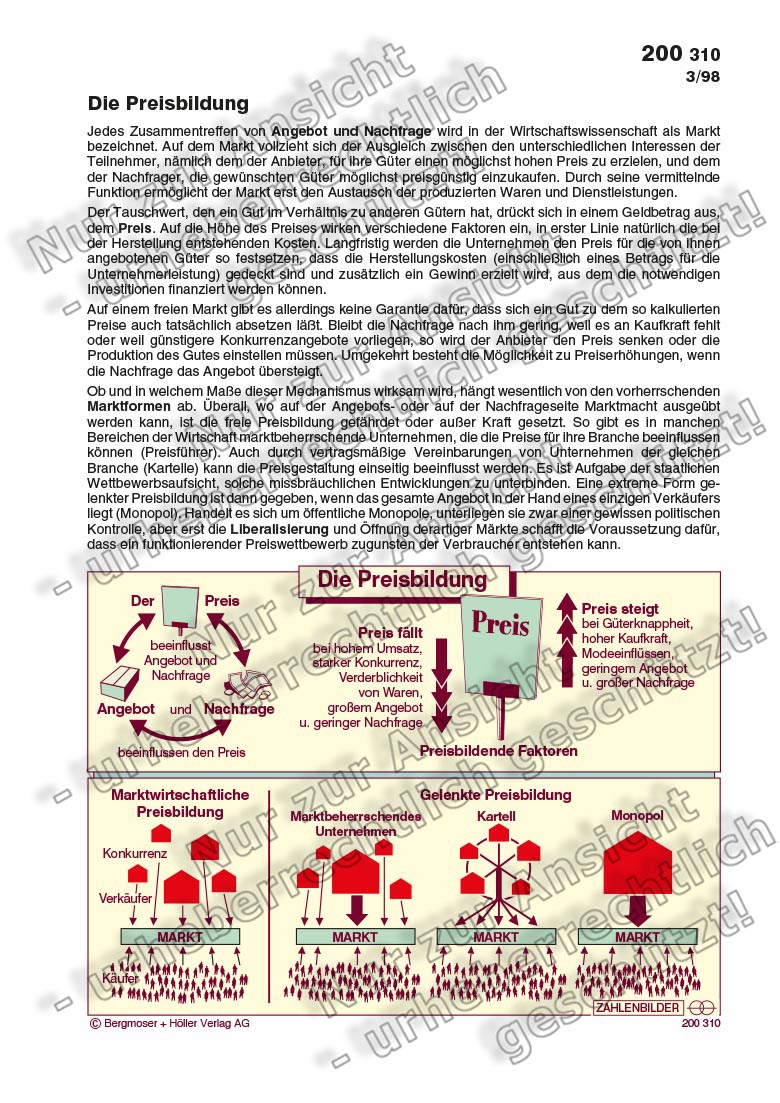

The bedrock of Preisbildung on any stock exchange rests on the simple yet powerful principles of supply and demand. When more buyers want to purchase a particular stock than there are sellers willing to part with it at the current price, demand exceeds supply, pushing the price upwards. Conversely, if more sellers wish to offload a stock than there are buyers interested in acquiring it, supply outstrips demand, leading to a downward movement in price. This constant push and pull occur through orders placed by market participants. Buy orders (bids) represent the maximum price a buyer is willing to pay, while sell orders (asks or offers) indicate the minimum price a seller is willing to accept. The point where a bid and an ask converge creates a trade, and this trade price becomes the latest market price, updating continuously throughout the trading day. This auction-like environment, facilitated by sophisticated electronic trading systems, ensures that prices reflect the immediate consensus of market participants at any given moment. The efficiency of this system means that new information is often very quickly incorporated into asset prices.

Factors Influencing Preisbildung on the Stock Exchange

While supply and demand form the foundation, numerous other factors exert significant influence on Preisbildung. Macroeconomic indicators, such as interest rate decisions, inflation reports, employment figures, and GDP growth, can shift overall market sentiment and subsequently affect stock valuations across the board. For individual companies, their financial performance—quarterly earnings, revenue growth, profit margins, and future guidance—plays a critical role. Positive news, like a strong earnings report or a new product launch, can increase demand for a company’s stock, driving its price higher. Conversely, negative news, such as a missed earnings target or a regulatory investigation, can reduce demand and pressure prices downwards. Geopolitical events, industry trends, technological breakthroughs, and even major social events can also impact investor perceptions and expectations, leading to shifts in Preisbildung. For instance, a policy announcement from the US Federal Reserve can have global repercussions, influencing stock prices from New York to Tokyo.

The Role of Market Participants in Preisbildung

Various types of market participants contribute to Preisbildung. Individual investors, through their buy and sell decisions based on research, personal financial goals, or even sentiment, collectively influence prices. Institutional investors, including mutual funds, pension funds, and hedge funds, command vast amounts of capital, and their large-scale transactions can have a more pronounced impact on stock prices. Traders, from day traders executing numerous short-term trades to algorithmic traders leveraging complex computer programs, add significant liquidity and rapid price discovery to the market. Market makers, typically financial firms, play a crucial role by providing continuous bid and ask prices for specific securities, ensuring there’s always a buyer or seller available and narrowing the spread between buying and selling prices. Their actions facilitate smooth trading and contribute directly to the efficiency of Preisbildung, especially in highly liquid markets. The collective actions and beliefs of these diverse participants converge to form the market price at any given moment.

Real-World Examples of Preisbildung and Its Impact

Observing Preisbildung in action provides clear insights into its dynamics. Consider a technology company in the US that announces groundbreaking research results. This positive news immediately increases investor confidence and expected future earnings, leading to a surge in buy orders. As demand outstrips supply, the stock price climbs rapidly, reflecting the market’s re-evaluation of the company’s prospects. Conversely, if a major oil producer reports lower-than-expected production figures combined with a significant safety incident, sellers might rush to exit their positions. The sudden influx of sell orders would overwhelm demand, causing the stock price to fall as the market adjusts its perception of risk and future profitability. Even broader market events, like a global economic downturn or a sudden interest rate hike by a central bank, demonstrate Preisbildung on a macro scale, causing widespread selling across various sectors as investors re-evaluate the risk-reward profiles of their holdings. These real-world scenarios highlight how Preisbildung is a continuous, responsive, and often swift mechanism for integrating new information into asset valuations.